3 Credit Card Goals for Your Credit Union in 2022

El Salvador Shows Crypto is the Future of Currency

Cryptocurrency in the past decade has seen a massive boom in usage and relevance to the current economic climate. This phenomenon has occurred in the United States and globally.

Protect Members From Identity Theft

Help Protect Your Members From Identity Theft!

Having our personal information stolen from us is not something we want to think might happen to us, but it does. How often have you had to change your credit card numbers and passwords because of breaches or direct threats?

America’s Internal Migration

Projections put U.S. migration between 14 million and 23 million moving by the end of 2021, with 47% of prospective movers saying the deciding factor was seeking areas with a lower cost of living.

Is buy now pay later the next scourge on consumer finances?

Many consumers using Buy Now Pay Later products are avoiding taking on credit. The problem is they actually are still taking on debt. They just don't have the opportunity to boost their credit scores by doing well and paying off debt, and many of those consumers also end up taking out a loan or overdrawn their accounts just to pay off the Buy Now Pay Later.

The Problem With Buy Now Pay Later Programs

“It can be yours for just three easy payments of $19.95.”

That’s the pitch.

Cause Marketing Brings in $10K for Suncoast CU Community and $2.6M in Car Loans

P1FCU Engages Digital Align for its Transformation Journey

NAFCU’s Newest Campaign Aims To Take On The ‘Big Bank Bullies’

The Omicron COVID Variant Cannot Result in More Lockdowns

What President Biden’s Infrastructure Bill Means For Credit Unions

Free College Would Be a Disaster for the U.S.: A Gen Z Perspective

The Death of Overdraft and NSF Fees – But NOT Your Noninterest Income

Credit unions and banks are getting squeezed on all sides regarding overdraft protection and associated fees. Here’s what’s going down and how to replace them.

How “Shock Therapy” Economics Have Been a Resounding Success – And What it Could Mean for Credit Unions

The economic model commonly known as “shock therapy” represents large scale privatization and economic liberalization within a relatively short period of time. This is what it could mean for credit unions.

CU Strategic Planning Client Credit Unions Awarded More Than $20 Million from CDFI Fund

Credit Union Strategic Planning, the credit union movement’s largest organization for helping credit unions obtain Community Development Financial Institutions Fund grants from the U.S. Treasury Department, facilitated nearly half of all successful 2021 CDFI FA grant applications for credit unions, totaling $20 million.

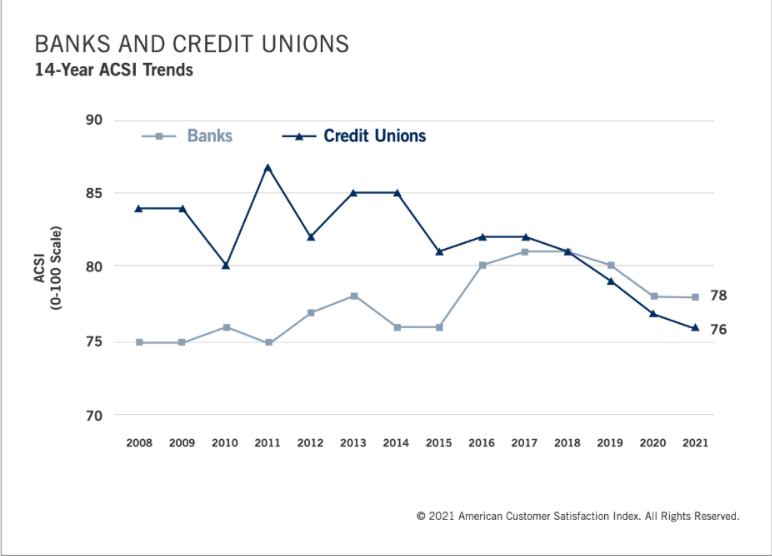

Fear Is Causing Credit Unions to Lose Ground to Banks

Banks tied credit unions a few years back in customer satisfaction, but now the trend is continuing to decline for credit unions. This data…

Millennials Need Advice…Financial Advice

The pandemic hurt the wallets of Americans, but in the case of many millennials, the exact opposite happened to their finances.

The Future is Bright for Blue Collar America

There has, in recent years, been a feeling that America has been moving further and further away from blue-collar labor, which is largely true. Detroit is no longer a bustling hub of automotive manufacturing, but a decrepit ghost town…

Why the 2021 Economic Situation is Oddly Disastrous

The COVID-19 pandemic and the government response to it has no doubt wreaked havoc on the economy. But the consequences are relatively unique to this current circumstance compared to past economic woes. According to a memo released by the Bureau of Labor Statistics on October 12th, there are currently, in the United States, 10.4 million jobs that are needing to be filled.

GAO Puts the NCUA on Report: The Questions You Need Answered

While many a credit union leader may have smirked when the Government Accountability Office slapped the NCUA on the wrist for steps it deems necessary for effective oversight of credit unions, particularly as credit unions’ CAMEL (soon to be CAMELS) ratings decline and depending on which element falls.